A few months ago, many hoped that following a brief economic decline brought on by the coronavirus (COVID-19), things would quickly bounce back to “normal.” In no time, the job market would restabilize, struggling businesses would soon again prosper, or at least resteady.

But with case rates still high in King County and a full reopening of the state still a distant prospect, the outlook has become murky.

“It is tough to say how this will play out. It is different than any other recession we have been in,” said Washington State Employment Security Department economist Anneliese Vance-Sherman in an email. “Usually, we can look at our data and take some measure of comfort in the familiar rhythm of economic ups and downs. COVID-19, and all of the economic turmoil that came with it, swooped in swiftly, taking with it the usual predictable rhythms. Job losses are usually swift (but not this swift or deep).”

Because the current situation is unprecedented, Vance-Sherman said, it’s probably better to compare coronavirus-related economic effects with ones seen as a result of natural and man-made disasters. As she noted in a separate conversation with the Snoqualmie Valley Record, a quick economic recovery in Washington, typically referred to as a “V-shaped” recovery, will likely not be happening. Rather, a U-shaped recovery, or a recovery that unfurls in waves, is more probable.

The number of people who have filed initial unemployment claims on Mercer Island (98040) is lower than earlier in the pandemic’s onset in recent weeks (meaning those who filed for the first time, regardless of acceptance). However, numbers are still susceptible to jumping upward and downward. The number of those continuing to collect unemployment is also lowering, but at a slower, fluctuating rate, reflecting the shaky prospect of a quick and straightforward recovery.

“There was hope at the start of the situation that jobs would be lost and that after a brief hiatus, the labor market would snap right back,” Vance-Sherman said. “I think we are seeing some jobs snap back (see the May [state, local and national]) and June ([national] jobs reports) but there is restructuring taking place. Some jobs will return, but will look different, some jobs will not return and some jobs will emerge that didn’t exist before.”

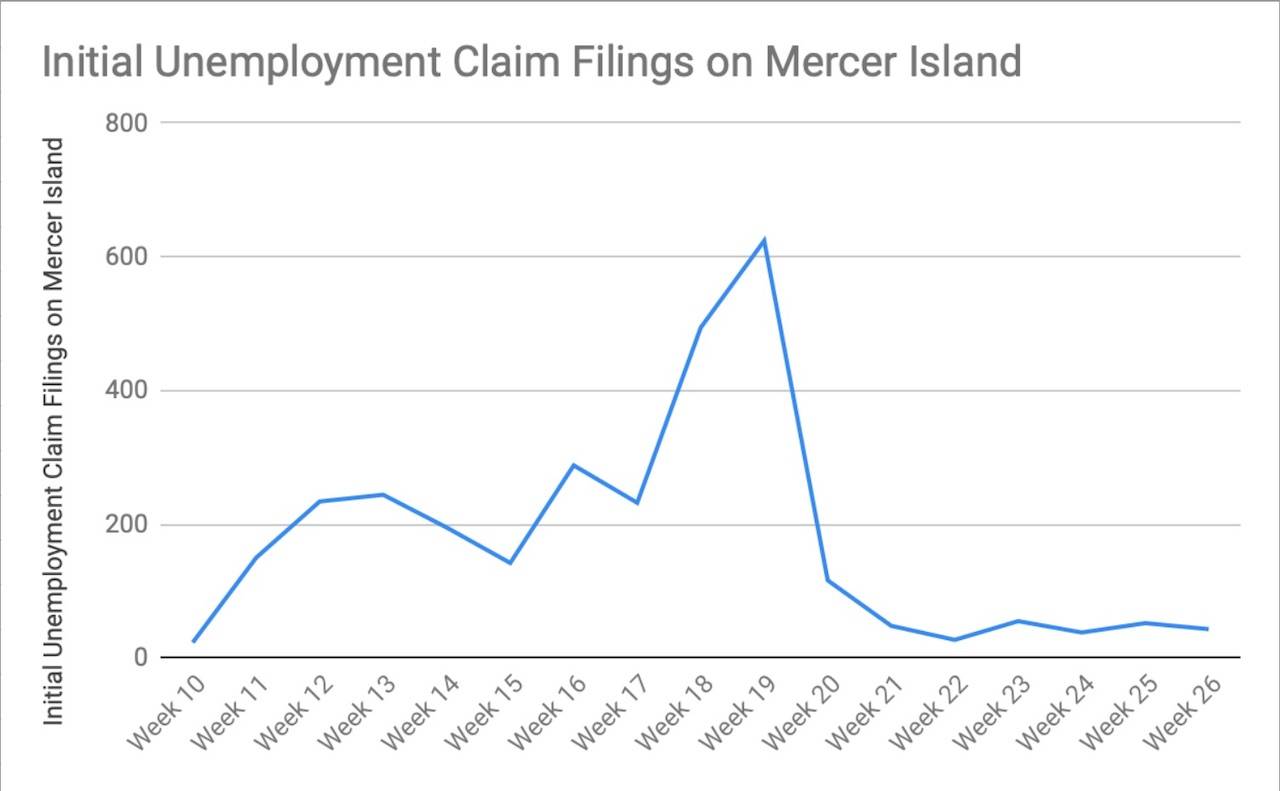

Initial claims, Vance-Sherman said, are especially indicative of a certain moment in time. On the 10th week (March 1-7) of 2020, for instance, 23 Mercer Islanders filed an initial unemployment claim. During this period, schools were closed, and pandemic-related restrictions were placed on bars and dining rooms.

On the 11th and 12th weeks, this number jumped to 150, corresponding with Gov. Jay Inslee’s Stay Home, Stay Safe Initiative and newly defined essential/inessential activities.

After a major initial-claims spike during the 19th week of the month — a sizable 624 filings — Mercer Islanders filing initial claims have gone down. By week 20, the number went down to 116. The most recent count period, week 26, saw 43 filings.

But even though the number of initial-claim filings is lowering, those who are still collecting unemployment on Mercer Island remains high. The largest jump occurred between week 18 and week 19 — going from 885 to 1,238 collections — but between Week 22 and the most recent filing week, Week 26, collection has stayed somewhere between about 575 and 485. (It’s worth noting that this shift has mostly gone downward.)

Higher rates between the last few weeks of April are most likely related to Pandemic Unemployment Assistance (PUA), which became available to self-employed and other previously ineligible workers during week 16.

It isn’t totally clear how data collection has been affected by the influx of fraudulent claim filings — for which the state paid $650 million — in recent months. Vance-Sherman noted that the claims have dependably lined up with new announcements made by the governor’s office.

On Mercer Island, the top industry sectors are health care and social assistance (1,014 jobs), educational services (996), finance and insurance (743), retail (576) and a mixture of professional, scientific and technical services (548), per a 2017 analysis.

Vance-Sherman said it’s tough to say when the labor market will restabilize.

“This is a historically anomalous situation,” she said. “Unlike other recessions, there was no specific sector experiencing changes that caused the downturn (think of the dot com bubble, or the housing bubble that ushered in the most recent recession). Thinking about the 2008 recession, it was the deepest recession we had experienced since the Great Depression in terms of job losses. This also led to the longest economic expansion on record. If the magnitude of job loss is an indicator, we could be in for a long period of recovery.”

Since March 29, those who filed for unemployment in Washington have received an additional $600 on top of what they would normally collect via the CARES act. The supplement has helped those who have lost their jobs, or those who have returned to work at reduced hours, stay afloat during a precarious period. So there is a widespread concern on a statewide level about what the ramifications might be when the financial appendage expires July 25.

Vance-Sherman said she isn’t confident theorizing about what exactly the repercussions will be in part because of this loss, but said that the onset of COVID-19 has illustrated society’s interconnectivity.

“We know that unemployment insurance dollars tend to be spent rather than saved, and end up circulating in the economy,” she said. “Immediate repercussions will involve the trade-offs that people make in their day to day spending. Will bills, rent or food take priority? Some people will return to work and some will not, and returning to work unsafely could lead to an increased incidence of COVID. There are just so many moving parts.”

Many continue to speculate whether there will be another statewide “shutdown” like the one seen earlier this year. The concern has become especially pronounced in recent weeks. King County has seen rising case numbers amid reopening measures. Other states, such as California, are doing some walking-back after deeming reopenings of certain sectors safe.

It’s too soon to tell what the reverberations would look like, exactly, if another lockdown were to occur. Vance-Sherman, like many business owners, isn’t altogether optimistic when thinking about how a second lockdown could have an impact if a business that had struggled to stay open during the initial shutdown had to endure another one.

“Businesses and workers alike have been destabilized by this event,” she said. “Any businesses that survive[d] the first wave may not be financially able to withstand a second blow.”