As the greater Seattle area continues a population boom the latest rent reports show developers have kept up with demand as overall rent growth begins to balance out.

Seattle proper experienced a 1 percent rent growth over the past year, lower than nearly all Eastside cities along with the state and national averages according to Apartment List, a national company that provides renters with market trends. The company compiles monthly reports on numerous cities throughout the country and sources its data to the Census Bureau’s American Community Survey and combines that with its own listing to avoid sample biases that may skew toward luxury apartments.

The full methodology can be reviewed at https://www.apartmentlist.com/rentonomics/apartment-list-new-rent-methodology/. While the provided data covers most Eastside cities, the monthly reports excluded Issaquah and Snoqualmie.

“We’re essentially the nation’s fastest growing rental platform,” said Chris Salviati, housing economist at apartment list. “Throughout Seattle is a slowdown [of rate increase] across the greater metro area, and we saw that start in 2018.”

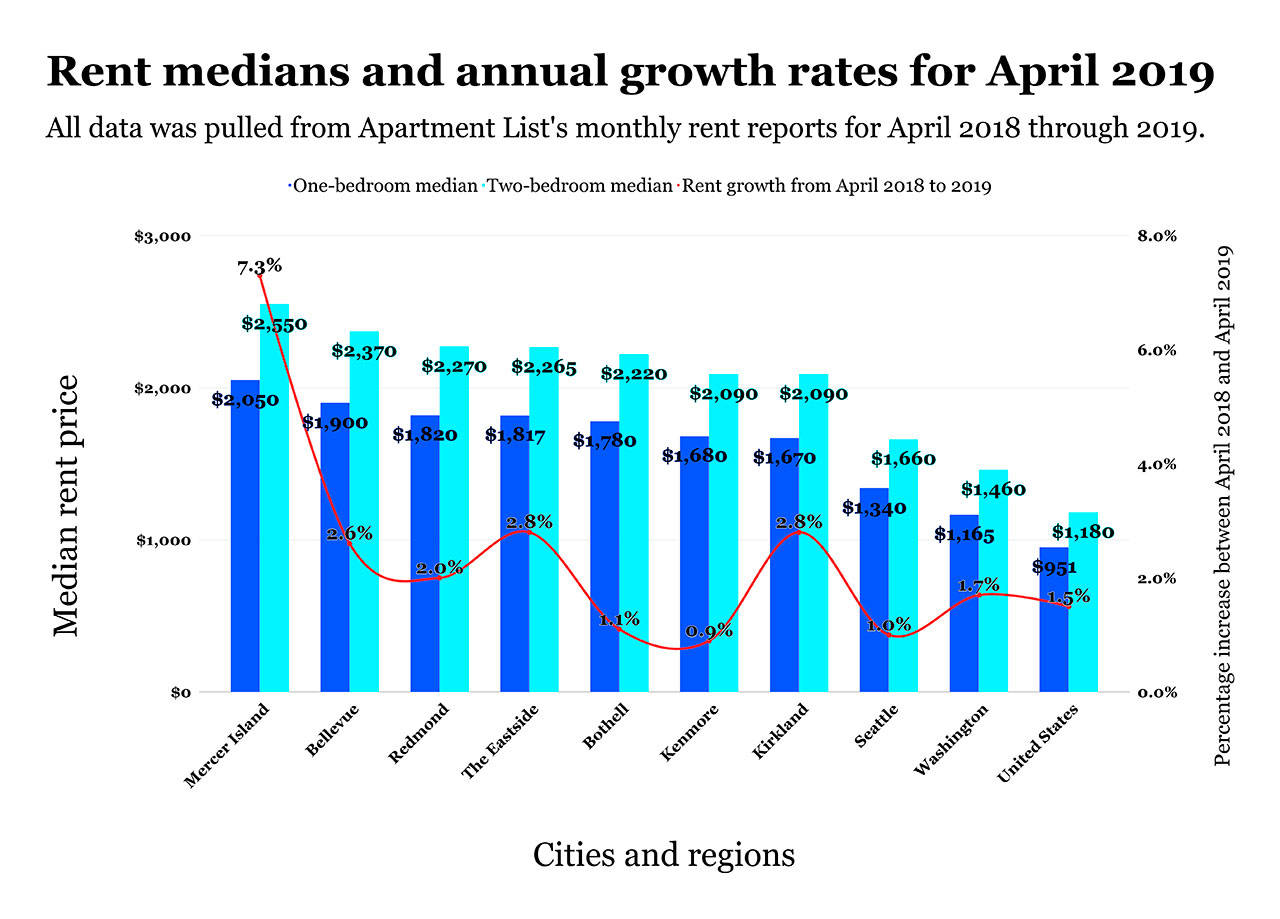

The Eastside as a whole maintains a growth rate of 2.8 percent between April 2018 and April 2019 — more than a percentage point above the Seattle rate at 1 percent, Washington rate at 1.7 percent and national rate at 1.5 percent. Mercer Island is a driving factor in the growth rate with the highest in the region, tripling most rates at 7.3 percent.

Overall, the Eastside’s growth rates have been on the decline, along with the region since 2018. Salviati credits that to developers throughout the region who have kept up with demand as new workers flood Seattle’s growing tech hub.

“We tend to think of this in a supply and demand framework,” Salviati said. “Demand being people looking for housing — which is closely intertwined with the job market — and the supply side is how developers respond with the construction of new housing. What we see in the Seattle region is an appropriate response on the supply side.”

Essentially, as new construction stays healthy in the region, along with the economy, the renting market will eventually balance out to a healthy 1 to 2 percent, according to Salviati. However, rental rates tend to fluctuate in cycles with macro-economic conditions and will likely change drastically with the next recession.

While this lowering rate is mostly good news for renters in the region — compared to previously seen 8- to 10-percent jumps in rent that could instantly price people out of their homes — rent medians are still increasing overall and supply has not caught up enough to significantly help the affordable housing crisis.

“The response [from developers] has tempered that increase we saw in 2015, 2016 and 2017, which is good news for renters,” Salviati said. “The economy is really strong right now, Seattle will continue to be a place to thrive. But as the overall national economy at some point recedes, that’s when you usually tend to see prices dip [with] weaker macro-economic conditions… But this is definitely a positive sign that [the rent rate] leveling out.”

At the end of April, Mercer Island held the highest median rent on the Eastside with $2,050 for a one-bedroom apartment and $2,550 for a two-bedroom, increasing from March by 1.6 percent.

Second highest was Bellevue with a $1,900 one-bedroom median and a $2,370 two-bedroom median. That is up 0.4 percent from March.

Redmond came in at third highest, closing the month with medians of $1,820 for one bedroom and $2,270 for two bedrooms — up 1.7 percent from March.

On the north Eastside, Bothell and Kenmore took the fourth- and fifth-highest rent in April with a $1,780 one-bedroom and $2,220 two-bedroom median for the former and a $1,680 one-bedroom and $2,090 two-bedroom median for the latter. Bothell saw a 1.5 percent increase from March while Kenmore only increased by 0.5 percent.

Kirkland was close behind Kenmore, holding a 1.3 percent increase from March, ending April with a $1,670 median for one bedroom and equaling Kenmore’s $2,090 median for two bedrooms.